Debt Collection Pressure and Mental Health

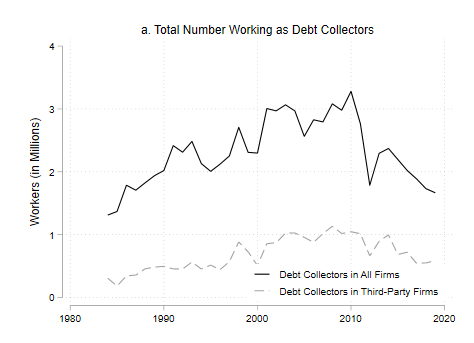

The U.S. debt collection industry has grown in tandem with rising household indebtedness. Prior research on debt and mental health mainly treats debt as a resource and liability, rather than a power relationship between creditors and debtors. In a forthcoming paper in Journal of Health and Social Behavior, Rachel Dwyer, Jason Houle, and I examine the mental health consequences of debt collection pressure using data from the National Longitudinal Survey of Youth-1997 Cohort. Drawing on health power resources theory, we posit debt collection pressure as a relational stressor that undermines well-being through negative interactions with debt collectors, financial strain, role strain, and stigma. We find that one of every four young adults in this cohort faced debt collection pressure by around age 40, with higher rates among low-income and Black young adults. Individual fixed-effects and lagged dependent variable regression models indicate that debt collection pressure is associated with psychological distress, with more severe consequences among low-income young adults.